General Electric is a multinational conglomerate in aviation industry with a long, storied history full of innovation and revolution. It was founded in 1890 as the “Edison General Electric Company” and became a reflection of Thomas Edison – The Great American Inventor of 19th Century. Since its foundation, General Electric has created a history of innovation and leadership. The objective of this article is to Analyze GE’s Corporate Strategy with emphasis on following key concepts,

- Analyzing the 3 Horizons of Strategy of GE

- Analyzing GE’s Strategy Development Process across its 120 year history.

- Applying BCG Matrix to analyze why GE sold off some of its important Strategic Business Units.

- Applying Ansoff’s Product Market Growth Matrix to analyze huge number of acquisitions made by GE.

- Analyzing GE’s strategy as a Position, Pattern & Perspective over its history.

The analysis and research of the company from Strategic context is based on dividing the company’s history into 4 major periods and analyzing how company’s strategy worked in each time period.

GE Corporate Strategy Analysis (1892-1940)

General Electric is a multinational conglomerate founded in 1892 by Thomas Edison – the great American inventor. In the initial stages of GE, it adopted the strategy of Differentiation and became the first manufacturer/inventor of many electrical appliances to be used by general public. In this regard, some important inventions are given as under,

- 1900: GE establishes the first laboratory in the United States dedicated entirely to scientific research

- 1902: GE invents the first electrical fan

- 1906: The world’s first voice radio broadcast by GE engineer Ernst Alexanderson

- 1909: The ductile tungsten filament developed for lighting bulbs

- 1910: GE manufactures “Hotpoint”, the first electric stove

- 1917: GE starts production on the first hermetically sealed home refrigerators

- 1930: GE creates its plastics department to research and produce plastics for use in home appliances

- 1938: GE invents the fluorescent lamp, continuing their tradition of advances in lighting technology and design

- 1939: “Invisible” glass is invented at GE that is a non-reflecting glass to be used in camera lenses and optical devices

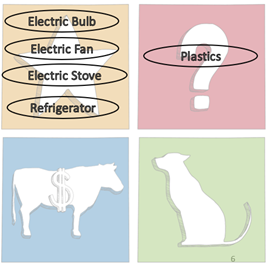

It is evident from above that GE had an Intended or Deliberate Strategy to innovate and create new products in home appliances market segment. Lead by the most prolific inventor of its time, Thomas Edison, GE became a reflection of his innovative and creative mindset. Household electrical appliances like electric bulb, electric fan, electric stove and refrigerators became the Star Products of GE generating the revenue required for venturing into new Question Mark Products like Plastics. By the end of above time period, GE had differentiated itself as a renowned Home Appliances Company.

GE Corporate Strategy Analysis (1941-1980)

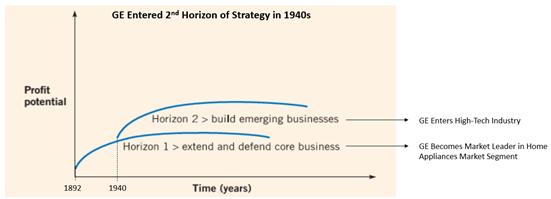

By 1941, GE light bulbs and home appliances had become Cash Cows. 1940s allowed GE to enter into the 2nd horizon of strategy i.e. to build emerging businesses by stepping outside of the home appliances market segment GE had initially been focusing on and investing into research and development of high-tech industrial products.

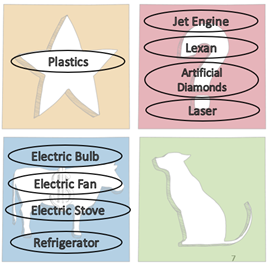

GE decided to build emerging businesses of Question Mark Products to find its next Star Product. Some of the important developments in subject time period are as under,

- In 1942, GE developed the first American Jet Engine – a product that became GE’s star product in the years to come

- 1943: – GE engineers develop autopilot, a device designed to keep an aircraft on a continuous predetermined course

- 1945: – GE demonstrates the first commercial use of radar, allowing vessels to navigate through darkness and unseen hazards as far as 20 miles away

- In 1953, GE developed thermoplastic chemical “Lexan” that served as a Star Product establishing GE’s Plastic Division as a Strategic Business Unit

- In 1955, GE developed artificial diamonds for industrial use

- In 1962, GE developed solid state laser for industrial use

In short, GE’s Intended Strategy had become to become a market leader in high-tech industrial products.

However, not all Question Mark Products developed by GE converted into Stars. One example of it was the computer business that GE ventured into. In 1960s, GE launched the GE-600 series 36 bit mainframe computers from its Computer Systems Division (Strategic Business Unit for Computer Market Segment). GE realized computers are a red ocean market dominated primarily by IBM – computer systems market leader of that time. Therefore, in 1970, GE sold off its Computer Business Division to Honeywell. Nonetheless, GE’s strategy emerged as a pattern where GE continued to innovate in high-tech industry repeatedly venturing for Question Mark Products & converting them into Star Products. By the end of 1980, GE was not Home Appliances company. It was Electrical Equipment Manufacturing Company.

GE Corporate Strategy Analysis (1981-2001)

The period between 1981 to 2001 is considered to be one of the most important periods not only in GE’s history but in history of corporate strategy and management. GE’s market capital rose from $12 Billion in 1981 to $410 Billion in 2001.

GE’s success in the 1981-2001 period is attributed to Jack Welch, a Chemical Engineer by education with a background of serving as head of multiple business divisions at GE, especially the head of Strategic Planning, who became the youngest CEO of the company’s history in 1981. He was named “Manager of the Century” by Fortune Magazine in 1999.

Markers of GE’s strategy in the period starting from 1981 to 2001 are explained below,

GE’s Strategizes for Conglomerate Diversification – Entering the 3rd Horizon of Strategy with 600 Acquisitions

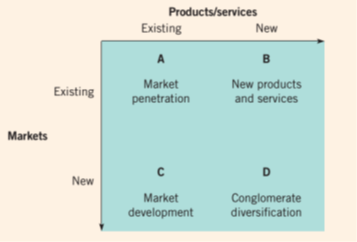

This period of GE can be analyzed in the light of Ansoff’s Product Market Growth Matrix as given under,

While GE started acquisitions even before 1981, the real wave of expanding GE’s business was experienced from 1981 to 2001 in which GE acquired 600 businesses. GE’s corporate strategy focused on “Growing Fast in a Slow Growth Economy” as highlighted by the new CEO Jack Welch 1981 speech. It was the Intended Strategy of GE to grow itself out of the conventional business it was dealing in and look out for new opportunities to expand the company beyond high-tech manufacturing.

Some of the notable acquisitions are described below,

- GE acquired Radio Corporation of America (RCA) in 1985 – an electronics and radio broadcasting company thereby claiming ownership of some famous news channels including NBC news and CNBC.

- In 1985 GE acquired Technicare that produced a range of CT scan machines, X Ray equipment and some MRI machines with an already well established customer base in healthcare industry.

- In 1986, GE acquired Kidder, Peaboy and Company – a financial services companythat dealt in investment banking, brokerage, and trading. Around the same time, GE acquired financial services companies Dart & Kraft Leasing company and Kerr Leasing company as well as Gelco Corporation, a much larger leasing company that also included other financial-services businesses.

- In 1990, GE acquired its competitor, the Hungarian electric bulb manufacturing company “Tungsram” that was the third largest electric bulb producer in the world.

- In 1991, GE acquired Chase Manhattan Bank’s leasing unit to integrate it into GE Capital – Financial services division of GE.

- In 1997, GE acquired Greenwich company that dealt in jet engine maintenance and overhaul services principally in the United States and Scotland. The same year, GE acquired Lockheed Martin Medical Systems division to make its footprint strong in healthcare sector. As well as Stewart & Stevenson Services’ gas turbine division.

- In 1998, GE acquired Diasonics Vingmed Ltd. That dealt in ultrasound imaging business. The acquisition was aimed for improving GE’s healthcare business division. The same year, GE acquired MR businesses of Elscint – an Israei company dealing in production of medical imaging solution, as well as Marquette Medical Systems – the top U.S manufacturer of its time in electrocardiography equipment used to monitor vital signs.

- GE acquired SYPROTEC in 1999. It manufactured products and supplies services to monitor and manage oil-filled power transformers to provide innovative maintenance solutions to transformer maintenance companies. The same GE acquired Prucka Engineering, Inc. – an American company specializing in electrophysiology; a French engineering company Alstom’s heavy duty gas turbine business and Japan Leasing Corporation.

The acquisition of Greenwich company, Tungsram and SYPROTEC clearly expressed the strategy of GE to become market leader in electrical equipment manufacturing industry. However, the most notable trend that can be seen in the acquisitions highlighted above are the acquisitions made to strengthen its Strategic Business Units in Financial Services Industry and Healthcare Industry.

While most of the people perceived GE as a jet engine and gas turbine company or an electrical equipment company, the acquisitions of GE clearly expressed GE’s strategy of entering the 3rd horizon of strategy to grow out of its core electrical equipment business and strengthen itself in Financial Services and Healthcare industries. It is a clear sign of GE’s strategy for Diversification where GE strived for expanding into business not known to GE in the past.

In 1999, GE CEO Jack Welch took up the matter with Fortune Magazine to reclassify GE from “Electrical Equipment Company to “Diversified Financial Services Company”. At the end of 2001, GE’s net earnings had 41% share of its Financial Services business. When these facts are viewed from strategic perspective, it becomes evident that GE’s Strategy as a Position was to remove the “electrical equipment company” mark from its brand and rebrand itself as a major player in financial services market.

GE’s Strategy for Market Position – Fix, Sell or Close!

From 1981 to 2001, GE strategy was based on attaining market leadership. The corporate strategy was that GE had to be the number one or number two in every business it was in otherwise the business will have to be fixed, closed or sold. In this regard, notable business units sold off by GE are as under,

- GE sold its business unit Utah International Inc. that dealt in mining business in 1983.

- GE sold off its small household appliances business unit to Black & Decker in 1984.

- GE sold off its TV production business unit in 1985 due to intense competition in prices with far eastern companies.

- GE sold off its computer electronics division in 1987 as it had not been competing successfully with the top IT companies.

- GE sold off its Aerospace Division to Martin Marietta (now known as Lockheed Martin) in 1993.

- GE sold off its GEnie online solutions division to IDT Corporation in 1996.

From BCG Matric point of view, Utah International Inc., small household appliances division and computer electronics division fell in the Dog category i.e. GE neither had a good market share in the respective industries nor did they foresee market growth in those industries as GE was falling behind market leaders in Value Innovation i.e. GE was producing quality products and services, however, was lacking on competitive prices. For example, the ex-factory cost of GE TV sets was more than the price of Japanese TV sets sold in US markets.

However, GE Aerospace division’s case was different. It made electronics and systems for the military and aerospace industries, like radar, secure communications equipment and military and commercial satellites and had fair market share in industry with the potential for market growth.

However, selling off the aerospace division was a decision based on emergent strategy. In 1985, GE got banned from participating in Defense contracts after it lost case to Air Force for making false claims in receiving payments from Air Force in a $47 Million worth of defense contract. The aerospace division was primarily earning revenue from defense contracts as GE was the fourth largest defense contractor at the time. The setback experienced due to debarring from defense contracts acted as a major factor for selling the Aerospace Business in 1993.

The steps described above indicate that GE’s strategy was based on becoming a Market Leader or a Market Follower that was expressed in the form of selling off such SBUs that were not number 1 or number 2 in the markets they were operating in.

Strategy as a Perspective – GE as Informal, Agile & Lean Company

The set of changes that took place inside GE from 1981 to 2001 comprised major changes in GE’s culture. The perspective of GE as a multinational conglomerate with large hierarchies creating various layers of bureaucracy was changed as GE’s corporate management strategized to change GE’s perspective within and outside the organization from a formal corporation to an informal, agile, lean and mean company. In one of the interview, GE CEO Jack Welch stated,

“We are trying to get the soul and energy of a start-up into the body of a $60 billion, 114-year-old company”

In this regard, following noticeable changes were implemented organization wide,

- The famous employee ranking method known as Vitality Curve Ranking (also known as Rank & Yank, Stack Ranking and Forced Ranking) was pioneered by GE from 1981 in which employees were ranked against each other and every department had to declare the top 20%, the vital 70% and the bottom 10% of its staff thereby forcing departments to note considerable differences in performance. The bottom 10% staff was given an ultimatum to improve themselves next year otherwise they were released from employment contract. By 1986, more than 130,000 employees had been reduced from GE either through release from employment contract or through divesting of their parent business unit.

- All of the business of GE were reorganized into 15 lines of business falling under 3 main ‘circles’ – term given by GE management. These circles included Services, Core Businesses and High Technology. All businesses that were laying outside the these circles had to be applied the “fix, sell or close” strategy. Resultantly, GE closed around 150 of its conventional businesses to make itself lean.

- The concept of “Accelerated Decision Making” and “GE Work-Out” were implemented organization wide in which departmental teams had to dedicate 3-4 days for sessions based on open, candid and honest discussion on what is needed to be done for achieving departmental goals faster. The sessions were predicated on the concept that people closest to their work know it best and therefore decision making must not rest only with the top management. Anyone having any idea for improving something at the organization must be given chance for implementation cutting the layers of bureaucracy.

- From 1981 to 1985 GE spent $8 Billion to retool, reorganize and automate its manufacturing plants. 13 appliance factories were rebuild to incorporate automated industrial robots for faster manufacturing. One important example was expenditure of $300 Million for the complete automation of its locomotive assembly plant in Pennsylvania.

Above facts make it evident that GE strategized to change the prevalent perspective of the organization as a slow moving large conglomerate both within the company as well as outside it in media and general public. The perspective was changed as an agile and lean company that promoted an informal work culture with ‘getting the job done’ attitude.

GE Corporate Strategy Analysis (2002-Present)

GE market capital dropped from around $400 Billion in 2001 to around $100 Billion in 2021. The time period after 2001 is marked as a period of great loss and decline for GE.

GE’s strategy for Conglomerate Diversification continued into 2002 onwards as indicated by the following major acquisitions, however, in the same period, some major sell offs were also observed,

- In 2003, GE acquired Finnish medical devices maker “Instrumentarium” for $2.4 Billion.

- In 2004, GE Healthcare acquires Amersham PLC – a manufacturer of radio pharmaceutical products for $9.5 Billion. The same year, GE acquired Dillard’s Inc. credit card unit for $1.25 Billion while spinning off its insurance business unit as Genworth Financial.

- In 2004, GE acquired InVision Technologies – a manufacturer of airport security equipment. However, 81% of the same was sold off to French Company Safron in 2009.

- In 2006, GE acquired IDX Systems, a medical software firm, for $1.2 Billion. The same year, GE Advanced Materials division was sold to Apollo Management for $3.8 Billion.

- In 2007, GE acquired Smiths Aerospace – an aircraft engine and parts manufacturer for £2.4 Billion.

- The most notable decision taken by GE’s Corporate Management in was selling off of GE Plastics to SABIC – a Saudi based chemical manufacturing company for $11.6 Billion in 2007.

- In 2009, GE acquired Norway based wind turbine manufacturer ScanWind for $18.5 Million.

- In 2010, GE sold more than 50% of its stake in NBC Universal to Comcast to get itself out of the news and media business. The remaining stake was also sold off in 2013 to give sole ownership to Comcast.

- In 2014, GE decided to sell its appliance business to Electrolux – a Swedish home appliances company for $3.3 Billion, however, the deal was interrupted by US department of Justice foreseeing a monopoly situation in US market. Nonetheless, in 2016, GE sold the same to Chinese company Haier for $5.4 Billion.

- In 2017, GE acquired multinational oil and gas company Baker Hughes and merged it with GE’s Oil and Gas business unit, however, the same was sold off just one year after its acquisition in 2018 for $3 Billion.

Reflecting on the acquisitions and sell offs given above, one clear pattern emerges i.e. GE has a Realized Strategy to return to its origins i.e. Hich-Tech manufacturing industry. GE is strategizing to return to its roots of engineering and manufacturing in high-tech industry. The same became evident when John Flannery, the CEO of GE in 2018, gave the following statement when Baker & Hughes was sold off,

“Today marks an important milestone in GE’s history. We are aggressively driving forward as an aviation, power and renewable energy company”

Furthermore, GE has expressed plans to spin off its Strategic Business Units into independent firms as evident from the following statement of GE CEO in 2018,

“We are confident that positioning GE Healthcare and BHGE outside of GE’s current structure is best not only for GE and its owners, but also for these businesses, which will strengthen their market-leading positions and enhance their ability to invest for the future while carrying the spirit of GE forward.”

2008 Financial Crisis & Emergent Strategy of GE

The reason why GE completely changed its strategic direction from conglomerate diversification to market penetration and market development is due to the lesson learned by GE in the 2008 financial crisis. GE stock fell 42% in a single year in 2008 and the most affected SBU of GE was its Financial Services division that suffered a loss of more than $100 Billion in a single year. In the following years, GE could not revive it.

Therefore, GE’s Emergent Strategy was to strip down its Financial Services business unit. Consequently, GE greatly reduced the size of its Financial Services division by selling off the following major business units of the division,

- GE Capital Sponsor Finance

- GE Capital Real Estate

- GE Commercial Lending & Leasing

- GE Capital Rail Services

- GE Capital Bank

- GE Healthcare Finance Services

- GE Capital Equity

- GE Capital Transportation Finance

- GE Capital Corporate Finance – Aircraft

- GE Capital’s Mexican equipment lending and leasing operations

- GE Trailer Fleet Services

- GE Capital’s Japanese capital finance, fleet service and vendor finance businesses

- GE Capital’s American restaurant finance operations

As of now, GE has kept only two business units in GE Financial Services Division i.e. GE Capital Aviation Services and GE Energy Financial Services. Both of the stated business units reflect that GE’s strategic direction has changed from Conglomerate Diversification to Market Penetration, New Products & Services and Market Development.

Conclusion & Recommendations for GE

In view of the analysis made above, it is concluded that GE must continue with its Realized Strategy to remain in technology and manufacturing businesses and keep out of Financial Services business. That is so because GE’s Sustained Competitive Advantage lies in its ability to innovate in high-tech manufacturing businesses owing to the history of the company as an electrical equipment company.

Although GE’s success in 1981-2001 period in which GE’s strategic direction had been Conglomerate Diversification may lead one to think that GE had successfully expanded into diversified businesses, however, the later instability and decline of GE has been attributed to the same expansion. GE became an oversized bloated conglomerate that contributed to its decline. As far as we have analyzed GE’s strategy throughout history, the best strategy for GE is Differentiation in Technology Industry. Conglomerate Diversification within the Technology Industry has proved to be successful for GE, however, outside of it has proved unsuccessful.

References

- G.E. Annual Reports

- “Management Principles and Practices” Book by Lallan Prasad and SS Gulshan

- “Inside the Dismantling of GE” by Matt Egan, CNN Money

- “Why Jack Welch is Changing GE” by Thomas J. Lueck, The New York Times, 1985 Archive

- GE Company Official Website History Page

- “Remembering Jack Welch: Hard-Driving M&A Dealmaker, Celebrity CEO & Business Titan” by Darren Ressler, Intralinks, 2020

- “G.E to sell a unit for $2.4 billion” by Agis Salpukas, The New York Times, 1983 Archive

- G.E. Quits TV Production by Charles Storch, Chicago Tribune, 1985 Archive

- “GE Fined $1 Million, Faces Three-Year Pentagon Ban : Admits to Fraud on Missile Job”, Los Angeles Times, 1985 Archive

- “GE to Acquire Greenwich Air Services and UNC Incorporated”, G.E. Aviation Press Release, 1997 Archive

- “Chase Sells Leasing Unit to G.E., Others”, AP News, 1991 Archive

- “GE Acquires Instrumentarium For $2.4B”, Forbes, 2003 Archive

- “Dillard’s sells credit card unit to GE”, NBC News, 2004 Archive

- “General Electric Completes Spinoff Of Genworth Financial”, Forbes, 2004 Archive

- “GE boosts offshore wind with acquisition” by Martin LaMonica, CNET, 2009 Archive

- “GE unloads appliance division to Sweden’s Electrolux” by Gary Strauss, David Kender, Keith Barry and Grace Schneider, USA Today, 2014 Archive

- “GE decides to sell Baker Hughes stake just one year after acquisition”, Offshore-Energy Biz, 2018 Archive

- “How GE Capital puts all of GE at Risk” by By Geoffrey Colvin, Fortune, 2008 Archive

- “GE Capital Is No Longer Too Big To Fail” by Steve Schaefer, Forbes, 2016 Archive